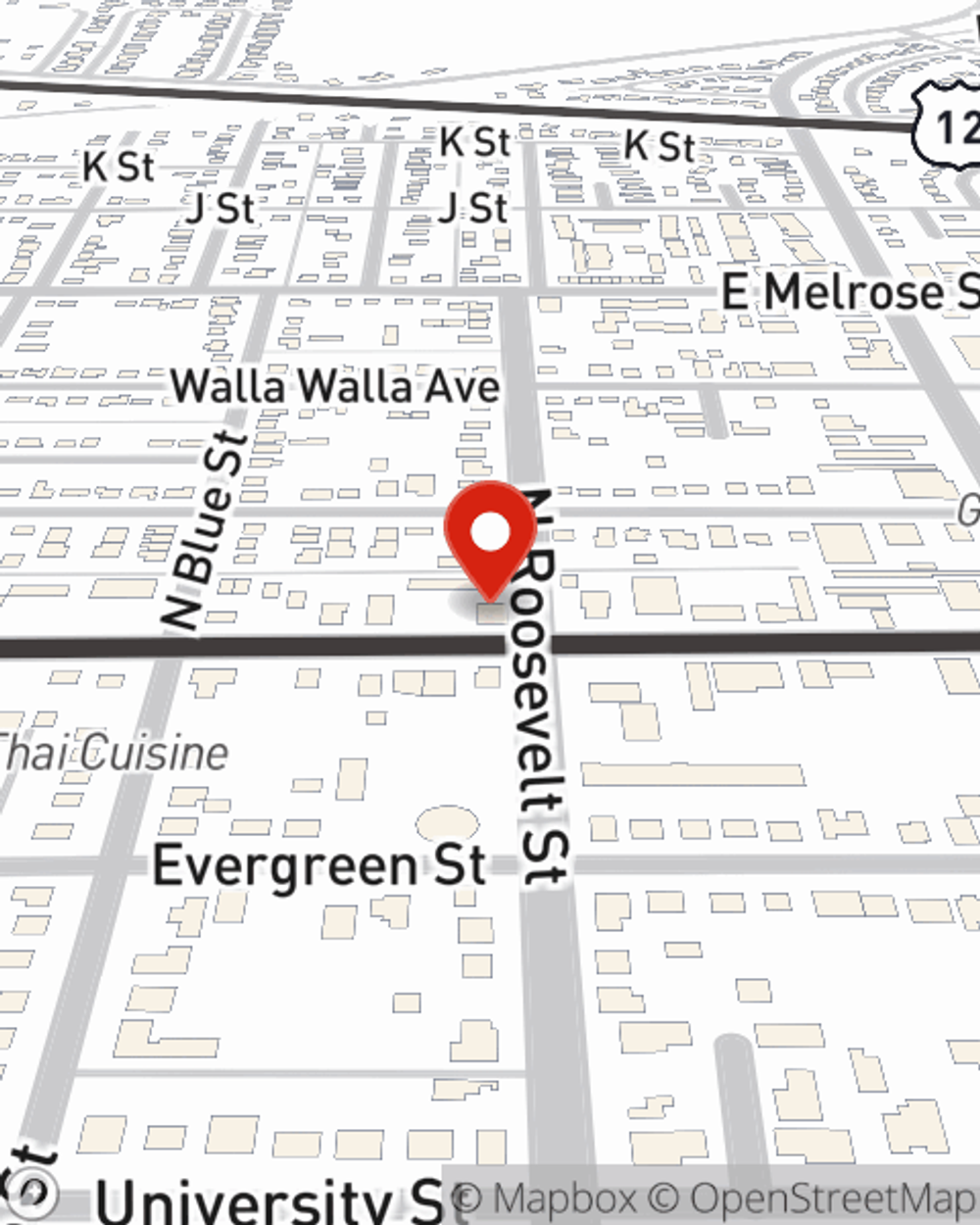

Business Insurance in and around Walla Walla

Researching insurance for your business? Look no further than State Farm agent Todd Bauman!

Insure your business, intentionally

Help Protect Your Business With State Farm.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Accidents happen, like a staff member gets hurt on your property.

Researching insurance for your business? Look no further than State Farm agent Todd Bauman!

Insure your business, intentionally

Surprisingly Great Insurance

With State Farm small business insurance, you can give yourself more protection! State Farm agent Todd Bauman is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Todd Bauman can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let the unknown about your business stress you out! Contact State Farm agent Todd Bauman today, and see how you can save with State Farm small business insurance.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Todd Bauman

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.